Coates Global

Your Gateway to Global Freedom

Expert Guidance in Golden Visa and Citizenship by Investment

Client-Centric Approach

Coates Global prioritises client satisfaction. From the initial consultation to post-approval support, the firm is committed to delivering a smooth and stress-free experience for every client.

Empowering Global Freedom

Your Trusted Partner in Global Mobility

Coates Global empowers high-net-worth individuals and families to secure a brighter future through bespoke residency and citizenship solutions.

With unparalleled expertise and a global presence, Coates Global is dedicated to delivering seamless, client-focused services. The firm’s team of experienced immigration lawyers and global consultants collaborates closely with clients to navigate the complexities of investment-based residency and citizenship. Coates Global’s bespoke solutions are tailored to meet the unique needs of each client, ensuring a smooth and successful journey towards achieving their personal and professional aspirations.

0+

0k+

0+

Real change is possible and that tomorrow doesn’t have to be like today

Citizenship & Residency Programmes

Your journey to global freedom starts here—choose a programme to unlock new opportunities

Latest News & Articles

Self Sponsorship visa

Establish a genuine business in the UK and secure residency with a flexible pathway designed for entrepreneurs and professionals.

Average Cost: GBP 50,000

Golden visa -

via Investment Funds

Secure residency in Portugal by investing in government-approved funds, offering a pathway to European citizenship in 5 years.

Minimum Investment: EUR 500,000

Golden visa -

via Property Investment

Gain Greek residency through strategic property investments, granting access to Europe and its thriving markets.

Minimum Investment: EUR 250,000

Italy Investor Visa – via Government Bonds or Funds

Secure Italian residency through strategic investments in state bonds or regulated funds, offering access to the EU, lifestyle benefits, and long-term settlement options.

Minimum Investment: EUR 250,000

Hungary Golden Visa via Real Estate Fund

Obtain a 10-year renewable residence permit in Hungary by investing in a government-approved real estate fund, with full Schengen access and future EU citizenship potential.

Minimum Investment: EUR 250,000

Turkiye Citizenship via Investment

Fast-track your way to Turkish citizenship through investment, unlocking opportunities in a thriving economy bridging Europe and Asia.

Minimum Investment: USD 400,000

Self Sponsorship visa

Establish a genuine business in the UK and secure residency with a flexible pathway designed for entrepreneurs and professionals.

Average Cost: GBP 50,000

Expansion Worker visa

Establish a UK branch for your overseas company or work for your UK entity—a great step to relocate to the UK.

Average Investment: GBP 250,000

Property investment

Invest in UK properties with mortgage options, earning high rental income and capital growth over time.

Minimum Investment: GBP 50,000

EU Citizenship via Investment

Achieve EU citizenship with Malta’s premium investment programme, providing full access to Europe and global mobility.

Minimum Investment and Other Costs: EUR 800,000

Malta Residency via Investment

Achieve Maltese residency by investing in the country, offering a pathway to European opportunities, global mobility, and Schengen access.

Minimum Donation: EUR 70,000

Golden Visa via Investment Funds

Secure residency in Portugal by investing in government-approved funds, offering a pathway to European citizenship in 5 years.

Minimum Investment: EUR 500,000

Golden visa via Donation

Obtain Portugal’s Golden Visa through a donation to cultural heritage or artistic projects, granting residency, Schengen access, and EU citizenship after 5 years.

Minimum Donation: EUR 200,000

FIP - Financially Independent Person visa

Secure residency in Portugal by proving financial independence, offering full residency rights and a pathway to EU citizenship in 5 years.

Minimum Requirement: EUR 12,000 passive income per annum

Freelancer visa

Gain residency in Portugal as a self-employed professional, with access to Schengen countries and EU citizenship after 5 years.

Minimum Investment and other costs: EUR 25,000

Digital Nomad visa

Work remotely from Portugal for employers or clients outside the country. Enjoy its vibrant culture, stunning landscapes, and a world-class lifestyle while staying connected to your global career.

Minimum Income: EUR €3,480 a month

Golden visa -

via Property Investment

Gain Greek residency through strategic property investments, granting access to Europe and its thriving markets.

Minimum Investment: EUR 250,000

Remote Worker Digital Nomad visa

Secure Greek residency as a remote worker, allowing you to live and work in Greece while accessing Europe’s thriving markets.

Minimum Requirement: EUR 3,500 monthly salary

FIP - Financially Independent visa

Obtain Greek residency by demonstrating financial independence, granting full residency rights and access to the Schengen Area.

Minimum Requirement: EUR 42,000 per annum passive income

Italy Investment Visa (Golden Visa)

The Italian Investor Visa offers a unique opportunity for non-EU nationals to obtain residency in Italy by committing to a qualifying investment.

Minimum Investment: EUR 250,000

Hungary Guest Investment Programme (Golden Visa)

The Hungarian Guest Investor Residence Permit is a newly launched programme, offering non-EU nationals a route to EU residency through.

Minimum Investment: EUR 250,000

Cyprus Residency via Investment

Secure residency in Cyprus through investment, offering a stable lifestyle, access to EU opportunities, and a favourable tax environment.

Minimum Investment: EUR 300,000

Cyprus Digital Nomad Visa

Embrace remote work in Cyprus, a Mediterranean hub offering a high quality of life, stunning landscapes, and an ideal work-life balance.

Minimum Income: EUR 3,500 a month

FIP Financially Independent Person Visa

Experience the Mediterranean lifestyle while enjoying the benefits of long-term residency in Cyprus with your passive income

Minimum Income: EUR €9,568 per annum

Turkiye Citizenship via Investment

Fast-track your way to Turkish citizenship through investment, unlocking opportunities in a thriving economy bridging Europe and Asia.

Minimum Investment: USD 400,000

Saint Kitts & Nevis Citizenship

Obtain second citizenship in St Kitts & Nevis through a quick and efficient investment programme, offering global travel benefits.

Minimum Donation: USD 250,000

Dominica Citizenship

Acquire citizenship via a contribution to the Economic Diversification Fund or approved real estate, offering global mobility.

Minimum Donation: USD 200,000

Grenada Citizenship

Secure citizenship through investment, providing visa-free travel to over 140 countries and eligibility for the U.S. E-2 visa.

Minimum Donation: USD 235,000

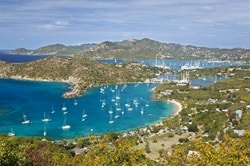

Antigua & Barbuda Citizenship

Obtain citizenship through a government donation or real estate investment, granting visa-free access to over 150 countries.

Minimum Donation: USD 230,000

Saint Lucia Citizenship

Obtain citizenship through a donation to the National Economic Fund or real estate investment, enabling visa-free travel to over 140 destinations.

Minimum Donation: USD 240,000

Ready to secure your future with global opportunities?

Let our experts guide you through the best Golden Visa and Citizenship by Investment programmes.