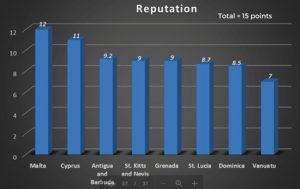

As shown in the image above, the Caribbean islands CBI programmes have reached an all-time high with their popularity ratings from investors. With the Caribbean nations leading the current trending and growing citizenship by investment programme industry, investors worldwide – primarily from Russia, China, the Middle East and Africa – are attracted to the concept of acquiring dual nationality via an affordable investment route that suits their needs.

A publication from the Financial Times released the 2018 CBI Index that ranks the world’s most active CBI programmes, crowning the Dominican programme as the most attractive on the market. The Dominican programme exceptionally scored perfect marks in five out of the seven pillars in which each programme is evaluated by. The top five places were allocated to all Caribbean nations confirming that as of 2018, the Caribbean CBI programmes are the most favoured programmes by the investors!

The pillars (areas) that CBI Index measures CBI programmes are the following:

– Due diligence

– Freedom of movement

– Standard of living

– Minimum Investment

– Ease of processing

– Citizenship timeline

– Mandatory travel/residence

– Due diligence

- Independent researcher and architect of the CBI Index, James McKay, deems these the most critical factors of any investor’s decision-making process when choosing the right CBI programme to obtain their second citizenship. He explains that;

-

“The CBI Index is rapidly becoming the leading tool for investors to accurately measure the performance and appeal of global citizenship by investment programmes.”

Throughout the CBI index special reports, the prime emphasis is falls on due diligence as this is the security and vetting procedures involved in each CBI programme ensure that morally questionable characters are excluded. The 2018 CBI Index highlights the due diligence process as a key component in differentiating the programmes.

CEO of due diligence experts S-RM, Heyrick Bond Gunning, stated that it:

“should be a staple of all CBI programmes that aspire to success and durability.”

Echoed from 2017 CBI Index, Dominica remains the world’s best CBI programme due to maintained high levels of timeliness and simplicity in process, an affordable investment threshold, and a robust due diligence framework. This result is a great testament and success to the nation of Dominica as their CBI programme has withstood the challenges presented by last year’s hurricane season. Dominica further serves as an admirable example of how CBI funds are used to improve the lives of its citizens, such as the recently announced construction of 5,000 new homes, financed entirely by the CBI programme.

With the latest upheaval over post-Brexit debates, this has ignited and raised awareness of the value of one’s citizenship and the certainty — or lack thereof — that it may hold. The impact of this can influence an inevitable result that freedom of movement is becoming a key element for investors to allocate their finances.

To find out more, please head over to the official CBI Index website at www.cbiindex.com.